by Bruce E. Parry

During the first year of the pandemic, the number of billionaires across the world grew by nearly a third, to 2,755 people. Here in the U.S., Jeff Bezos, former head of Amazon — which ruthlessly crushed a union effort at its warehouse in Bessemer, Alabama last week — leads the list at $177 billion according to Forbes. Just over a year ago, his net worth was estimated at $113 billion, meaning that as COVID-19 proliferated across the globe he grew his personal wealth by $64 billion. Elon Musk, founder of Tesla and SpaceX, is second on the list with $151 billion. Again, in March, 2020, Musk was worth an estimated $24.6 billion, meaning that he saw a single year gain of $126.4 billion.

How? How could these two men alone gain so much wealth in one year while millions are in poverty in this country alone? There are three broad answers.

First, the majority of the richest of these billionaires are in the tech industries. Even Musk, who is famous for his holdings in automotive and space, is deeply invested in developing battery technology to better run his electric cars and provide mobile electricity across industries. Technology has boomed during the pandemic because stay-at-home orders forced businesses and households to turn to tech to conduct their day-to-day affairs. As a result, technology stocks soared. Amazon’s revenue grew by 38 percent this last year; Tesla stock spiked 530 percent. Billionaires don’t live by working or laboring, but by owning companies. The growth in their ownership — stock portfolios — explains a lot about their increase in wealth.

Second, the government stimulus, particularly the first one in March and April, 2020, was the biggest transfer of wealth to big business and the wealthy in recent history, since the 2017 tax cuts; at least half a trillion dollars. This is one reason that the stock market — led by technology, though not exclusively— has been steadily increasing during the pandemic. The rest of the economy — unemployment, income, consumption, etc. — has been a problem. In addition, the Federal Reserve (the Fed), which is supposed to deal with banks, directly lent billions of dollars to major corporations, as well as to small and mid-size businesses.

Third, the Fed has pumped trillions of dollars into the financial system since the start of the pandemic. The Fed pumps money into the economy by buying mainly U.S. treasury bonds and making credit directly available to banks. Keeping interest rates below one percent has meant that it is really inexpensive for companies to borrow in order to buy back their own stock, thereby driving up its price. For the first time ever, the Fed has even been buying private corporate bonds and stocks, also to keep their corporate value up. A measure of how much the Fed has pumped by this method is that the Fed balance sheet of purchased financial paper, including bonds and stocks, increased by $3.53 trillion in the past year to $7.69 trillion, an increase of about 85 percent. The Fed has other ways of pumping up the stock market as well, but this gives you the idea. Meanwhile, financiers themselves are well represented on the billionaires list. The founder of Blackstone, a leading private equity firm, received $615 million in the last year, 20 percent more than the year before, mostly in stock dividends.

At the same time, the wealth of a huge section of the population declined, even with the stimulus payments. Before the pandemic, the Poor People’s Campaign and the Institute for Policy Studies found that 140 million people in the U.S., about 40 percent of the population, were in poverty or one emergency away from poverty. This section represents a huge part of the “essential” workers who over the last year have still had to go to work, but have been paid minimal wages, despite their importance to the economy. Millions of others have been laid off. Continuing claims for unemployment insurance — a measure of those still unemployed — is at 3.73 million workers as this is being written. Many more who are not working are not even getting unemployment benefits.

Unlike the billionaires who get money by just owning a company, the poor get money by working. They then spend it to buy necessities: food, clothing, shelter (renting or paying a mortgage), health care, transportation, entertainment and other basics. After that, there is often little or no income left, so their wealth never increases. If they fall short, they go into debt through the use of credit cards, payday loans, car notes, etc. In fact, this means the poor not only gain little to no wealth, but more and more find their wealth decreasing or going negative.

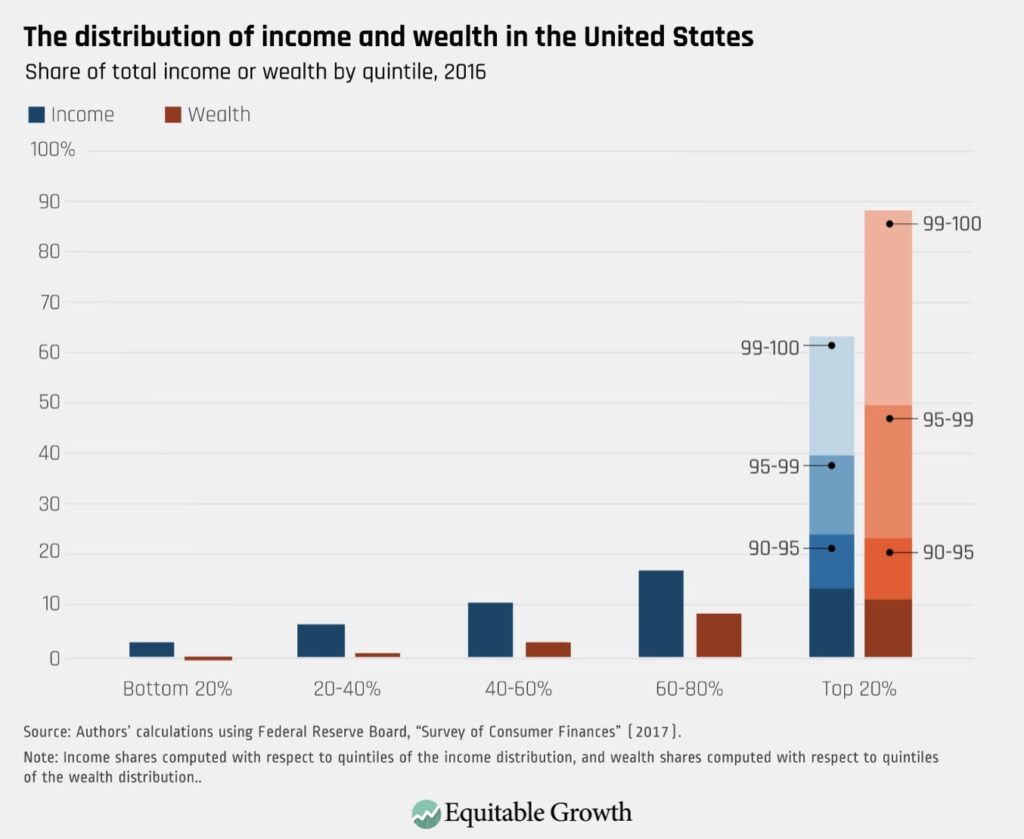

As a result, inequality increases, at an increasingly staggering rate! Billionaires, who number the same population as Casey, Illinois (population 2,756; one more than the number of billionaires), control the vast majority of wealth. The top 20 percent of the wealthy control about 88 percent. The poor and low-income — the bottom 40 percent — control almost none. Note that the top one percent of the rich control about 40 percent of the wealth in the United States.

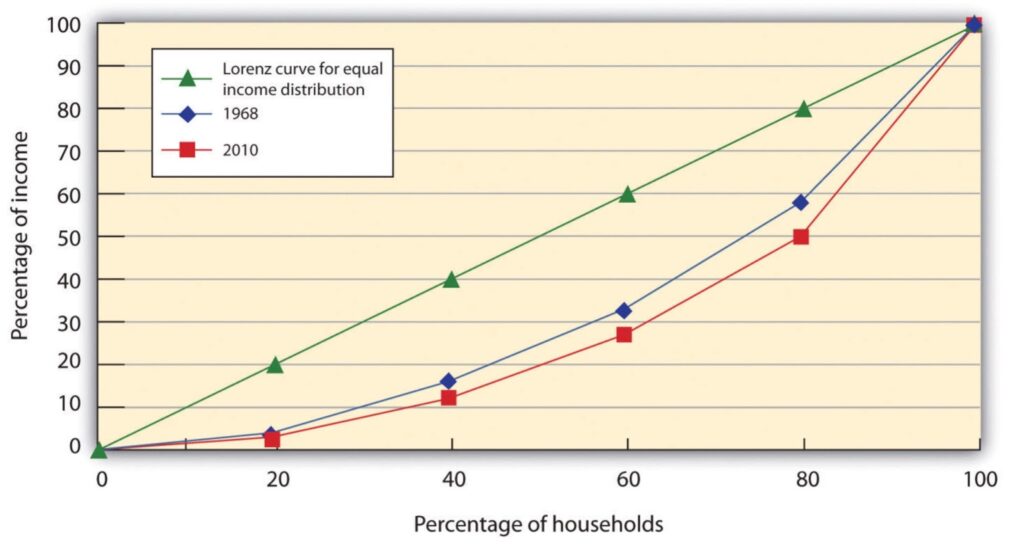

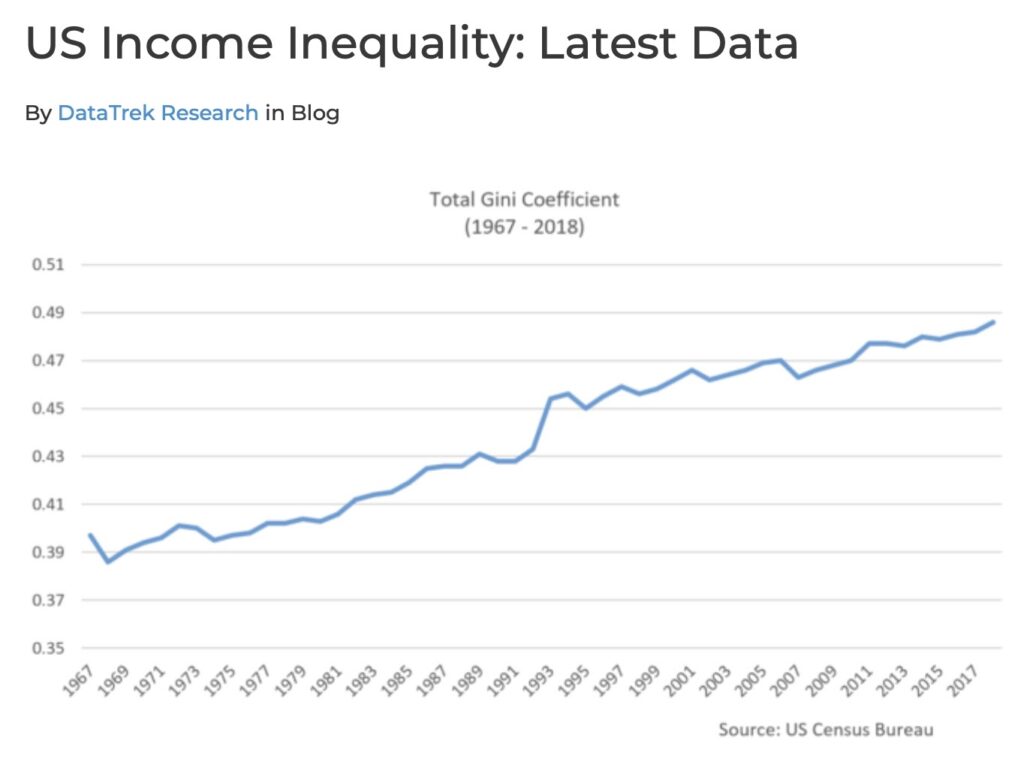

We use the Gini Coefficient to measure the level of inequality. Perfect equality would give a Gini Coefficient of zero. If one person owned everything, the coefficient would be one. The green line represents zero. You can see that the inequality — moving away from the green line — is increasing over time.

The graph below tracks how the Gini Coefficient has pretty steadily increased since 1967. In 2018, it stood at about 48.9 percent.

This shows that the fundamental polarity in U.S. society is between absolute, untold wealth and absolute, untold poverty. Homelessness — living in tents, in shelters, in squats, in cars or RVs, on the trains, doubled up or in any other form — is the worst aspect of absolute poverty.

The pandemic has proven one thing for sure: jobs are disappearing because the technology is available to have meetings remotely, repair machines remotely, transport the goods people buy remotely, measure health electronically, even, when necessary, to teach remotely. Technology is affecting every aspect of our lives, including the production and distribution of everything we need. Technology today is job-replacing, which means poverty is going to increase. And more unemployed people under capitalism means lower wages for those with jobs. There are over a billion unemployed people in the world. In the U.S., of all the new jobs created in the period before the pandemic, 44 percent, were for $18,000 or less. These trends threaten to only get worse, not better.

Finally, with the end of the pandemic — whether it’s sooner or later — moratoriums on evictions and on paying rent and mortgages will end. When they do, foreclosures and evictions will skyrocket. At least one estimate is that up to 40 million currently Americans face the risk of eviction. Homelessness will skyrocket as well. Many feel a great sense of optimism about the approaching end of the pandemic, and there is no doubt that we will all take a collective sigh of relief when the immediate threat of the virus is overcome. But on the other side, it is also likely that we will see widespread human devastation brought on by absolute poverty.

The interests of the poor — more than 40 percent of the population — are directly opposed to the interests of billionaires. The capitalists’ wealth went up by $8 trillion at our expense this last year. Our wealth went down. Those are the underlying realities of capitalism and of class today. It is our job as revolutionaries to bring this reality to the fore. As we do, we see the need to unite the poor on the basis of ending poverty forever!